In a significant move, the Government of India implemented a nationwide lockdown in a bid to contain the COVID-19 pandemic which has had a highly disruptive Economic Impact. The businesses are constrained from undertaking regular operations which has hit the revenue & sales, the production is negligible and with the restriction on logistics the entire supply chain

has got disturbed.

According to a new survey by social media and community platform Local Circles, 47% of the 13,970 startups and small and medium businesses (SMEs) who participated in a survey said that they have less than one month to no capital left to operate. As we stand today, gearing up to exit Lockdown 3.0, the call of the hour is to immediately Review the Cost Outlays and put in place a strategy for Business Resumption & Recovery. The businesses need to revisit their fixed and variable costs to ensure their financing remains viable.

Employee Compensation Cost is a fixed cost to the extent incurred on the Permanent Employees. This cost is settled by paying cash to the employees on a monthly basis utilizing the working capital of the business. In the prevailing circumstances where there is a challenge in financing the required working capital due to major hit on the liquidity & cash reserves; the

employers are finding it critical to plan & control the Employee Compensation Cost, along with the other operational costs, to continue the business effectively.

BUSINESS CONSIDERATIONS

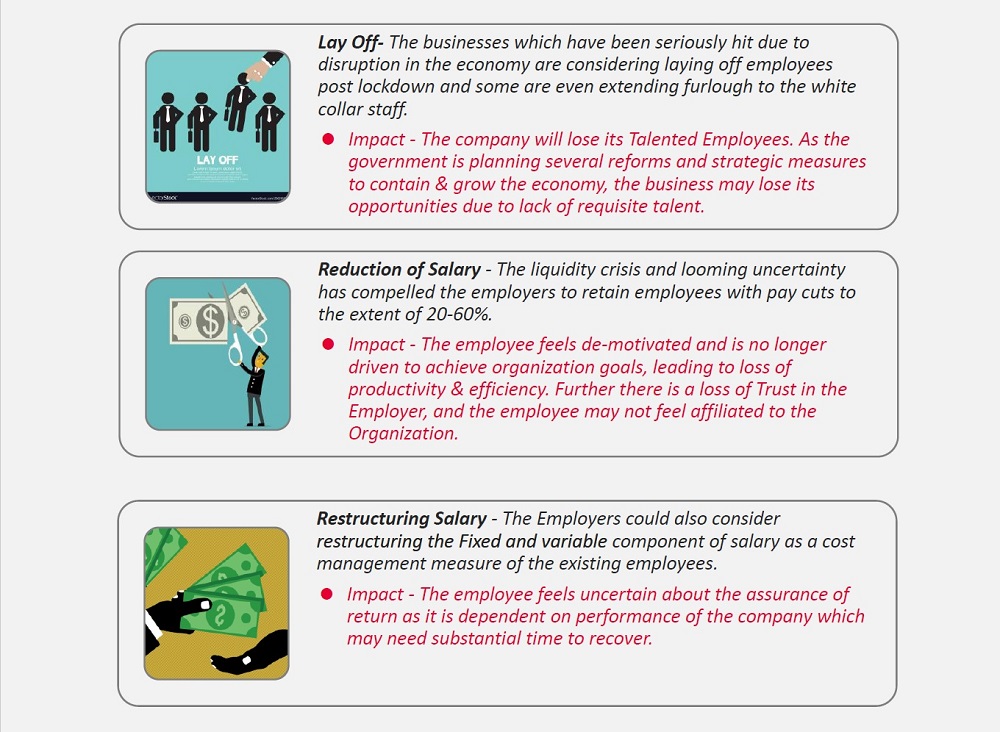

The different types, sizes and locations of businesses mean there are different things to consider while planning Employee Compensation Cost, which may involve-

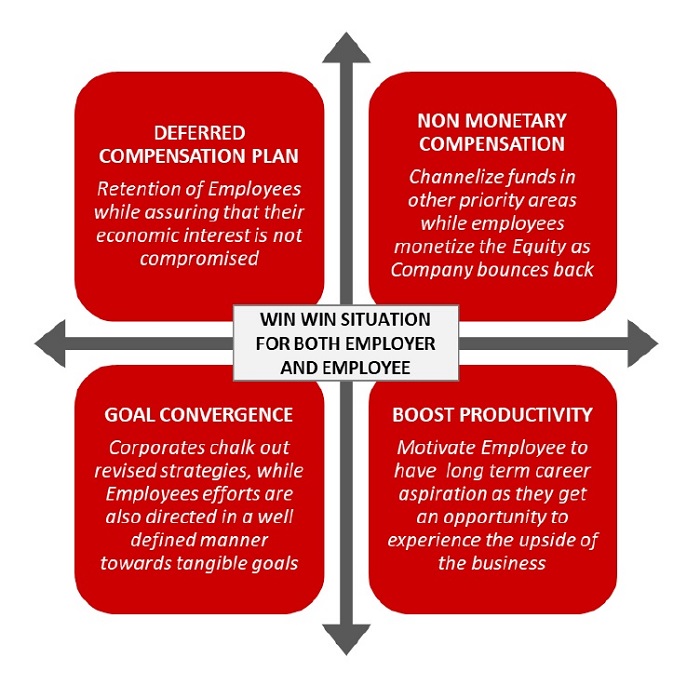

Including ESOPs as a Part of Employee Compensation Plan can help organizations meet the above considerations. ESOPs are an effective way using which we can defer the Fixed Compensation Cost of Permanent Employees and settle this liability in future through Equity Allotment; thereby benefiting them with increase in the equity value of the Company without any cash outlay.

As the businesses are opening their mind to new practices & adopting the ‘New Normal’; we believe there is also a need to relook at the Traditional Compensation Practices and consider ‘Share based Compensation’ of the employees through ESOPs.

ESOP IMPLEMENTATION

- Employee Stock Ownership Plans (ESOP) are a very popular form of employee

compensation. - It involves future issue of Shares of the Company to compensate the employee for their continued services in the organization for a specified duration.

- It is a non monetary form of Deferred Compensation which does not involve any cash outflow but is an allowable tax expense.

- It is an effective way to retain the employee and also hire new talent as it drives the employee to work towards future growth of the company.

- ESOP implementation is highly favorable in the current scenario as the business plans are deferred & redesigned but not dissolved and it is critical to retain, motivate & incentivize the employees to attain the organization goals.

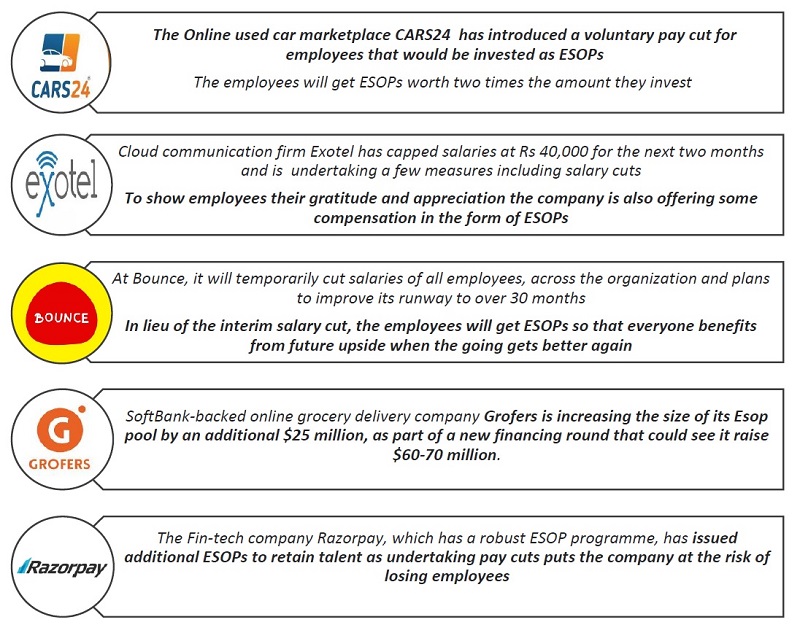

RECENT ESOP GRANTS

INDUSTRY PRACTICE OF ESOP

FAQs

1. Is it common for employees to be offered ESOP?

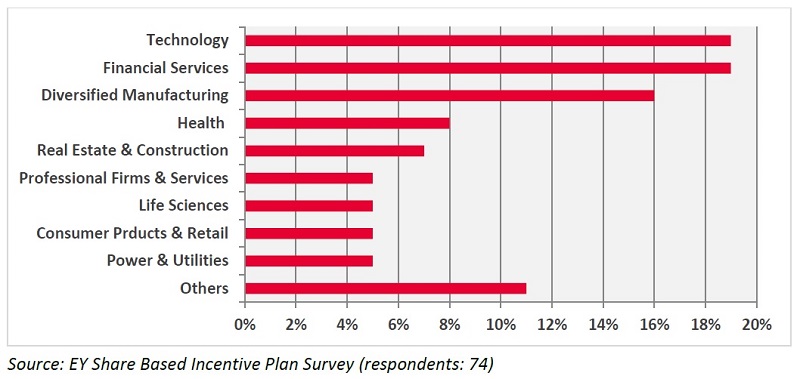

Information technology companies started the trend of offering share options to employees in India.

In the last several years, the trend has extended to several other sectors including Financial services, Diversified Manufacturing, Health, Real Estate & Construction, Life Sciences and Retail sectors.

Start-ups particularly find it a convenient mode of recruitment due to the unavailability of cash reserves.

2. Are there any alternatives to ESOP?

There are various alternatives modes other than ESOPs through which an employee can be compensated with Equity allotment:

- Stock Appreciation Rights (SAR)

- Restricted Stock Units (RSU)

- Employee Share Purchase Plan (ESPS)

- Sweat Equity Allotment

3. What are the main characteristics of ESOP?

Under ESOP an option is granted subject to a vesting schedule that is typically linked to tenure and/or performance.

On vesting of an option, an employee has the right to exercise the option. On payment of the exercise price, shares are issued to the employee and the employee becomes a member of the company

4. Can options be granted on a discretionary basis or must they be offered to all

employees on the same terms?

It is possible to grant options on a discretionary basis. The factors that are considered can include, among other things, an employee’s Tenure, Experience, Performance, Past contributions.

The number of options granted can be negotiated between a company and a

prospective employee.

5. Is the implementation of such employee share plan suitable under present Covid

Situation?

The Economy presently is severely battered due to Covid Pandemic, it is the most suitable time to implement such plan as Businesses are also facing Cash Crunch.

As ESOP as a form of Non Monetary Compensation it’s serves the dual purpose of Employee Compensation & effective Cash Management.

ESOP is a highly lucrative way to compensate employees in the present scenario.

6. Will the grant of Options be attractive to the employees given the stock prices are all

time low?

ESOPs are granted at a discretionary price by management which may be as low as the face value of shares of the company, which makes the Options highly attractive.

At the end of the vesting period the employee is likely to gain by selling the shares at the prevailing market price at any time, issued to him at the discounted exercise price

7. Is it lawful to offer participation in an employee share plan where the shares to be

acquired are shares in a foreign parent company or by Foreign Employees of Indian

Company?

The Exchange Control Laws permit a foreign company to grant share options to directors and employees of its subsidiaries in India or of its branch office in India.

Similarly Indian Companies can issue its shares to its Foreign Branch/Subsidiary employees under such plans.

Know more about ESOPs at https://www.corporateprofessionals.com/services/esop-advisory/

Contact Ms. Mohini Varshneya, Partner & Head – ESOP Services, 91 9971673332, mohini@indiacp.com