Key Managerial Personnel (KMPs) and senior management in Non-Banking Financial Companies (NBFCs) hold pivotal roles in steering their organizations toward success. Their influence on the company’s direction and growth cannot be overlooked, as their personal goals often mirror the broader objectives of the Company.

Recognizing the significant impact these designations have, the Reserve Bank of India (RBI) identified a crucial link between the roles of KMPs, senior managers, and the excessive risk-associated to their position in Banks and NBFCs. To address this, the RBI mandated the establishment of robust guidelines to have a Board-approved compensation policy within Banks and NBFCs. This decisive move was aimed at mitigating risks arising from poorly aligned compensation structures. Through these guidelines, RBIs have linked Employee Stock Ownership Plan as a part of the variable pay structure which shall be linked with the performance at an individual and company level.

To ensure that the goals of KMPs and senior managers are in sync with those of their NBFCs, the RBI issued comprehensive guidelines on their compensation structures. These guidelines, detailed in the RBI’s circular DOR.GOV.REC.No.29/18.10.002/2022-23 dated April 29th, 2022, provide a clear framework for NBFCs and their Nomination and Remuneration Committees (NRCs) to craft effective compensation policies. These guidelines came into effect on April 01st, 2023.

Applicability of RBI’s Compensation Guidelines for NBFCs:

These guidelines apply to all NBFCs under the SBR framework, with the exception of those categorized under the Base Layer and government-owned NBFCs.

Key Highlights of guidelines:

- Formation of Nomination and Remuneration Committee (NRC).

- Balanced Components and Risk Alignment in compensation.

- Deferment of a portion of the variable pay.

- Malus and Clawback Provisions.

What is an “ESOP”?

- Employee Stock Option Plan /Equity Incentive Plans (commonly referred to as ESOPs) give the employees an ownership interest by participating in the Stock /Shares of the Company.

- “Options/Units” is a right given to an Employee to purchase a given number of Shares of the Company at a future date, at a fixed pre- determined price.

Type of Equity Incentive Instruments offered :

- ESOP -Employee Stock Options Plans

- RSU-Restricted Stock Units Plans

- ESPS-Employee Stock Purchase Plans

- SAR-Equity Settled-Stock Appreciation Rights-Equity Settled

- Phantom Stock/SAR-Cash Settled-Stock Appreciation Rights

Lifecycle of ESOP’s:

- Grant: The company grants options to employees.

- Acceptance: Employees accept the options.

- Vesting: Options vest with the employees.

- Exercise: Employees exercise options, paying the exercise price and applicable taxes.

- Allotment: Shares are allotted to employees.

- Sale: Employees sell their shares.

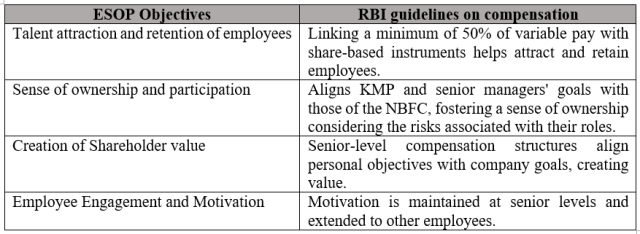

Alignment of ESOP Objectives with RBI’s Compensation Guidelines:

Taxation Aspects of ESOPs:

“There is a double point at which taxation arises in the hands of employee”

- At Exercise: The difference between the market price and exercise price is added as a perquisite under salary.

- At Sale: Employees are liable for income tax on the sale of shares according to applicable laws

Thus, adapting and aligning the compensation structure is essential to maintain fairness and in the interest of the employees.