SEBI (Issue of Sweat Equity) Regulations, 2002 (“Sweat Equity Regulations”) and SEBI (Share Based Employee Benefits) Regulations, 2014 (“SBEB Regulations”) were notified on September 24, 2002 and October 28, 2014 respectively.

The Sweat Equity regulations provided framework for issuance of Sweat Equity shares by listed companies and the SBEB Regulations provided framework to regulate Employee Stock Option Scheme, Employee Stock Purchase Scheme and other share based employee benefits.

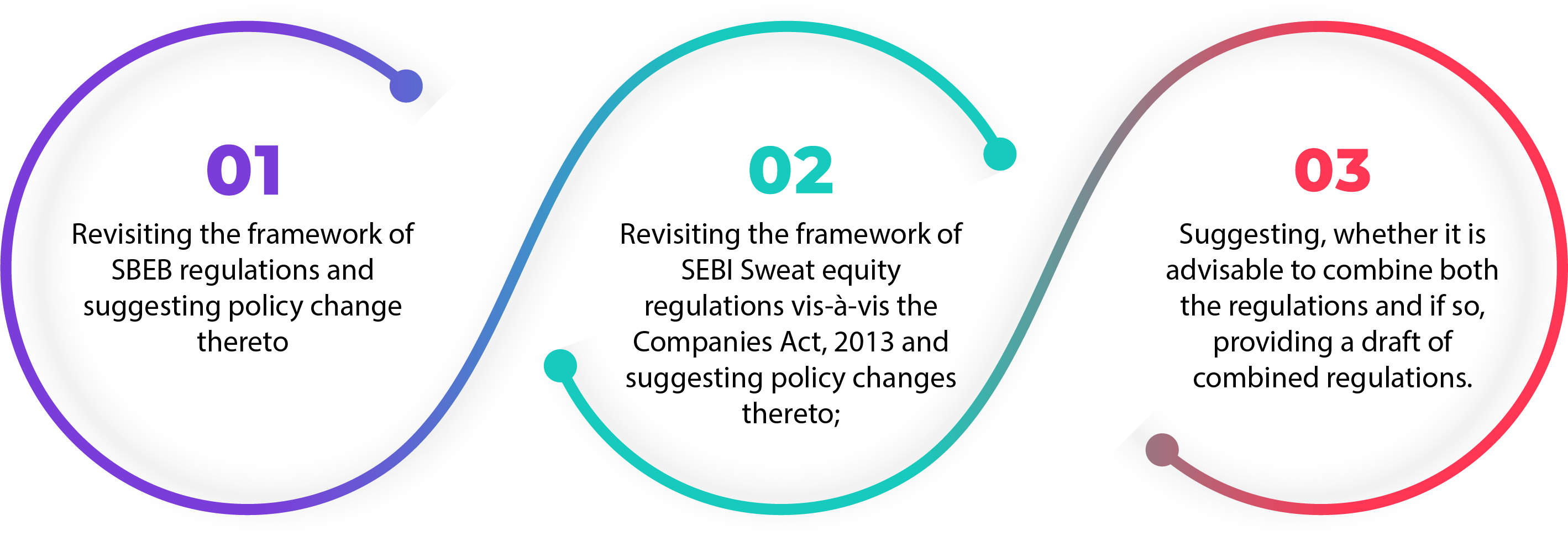

Pursuant to the receipt of multiple suggestions from stakeholders to further streamline and rationalize the provisions of these regulations, SEBI constituted an Expert Group with a mandate to provide recommendations on:

The Expert Group after deliberations in its several meetings submitted its report to SEBI on June 18, 2021. The Group made several policy recommendations including combining both the regulations (Sweat equity regulations and SBEB regulations) and also provided a draft of the combined regulations.

We are happy to share that we were also a part of the said Expert Group and availed the opportunity to provide our recommendations borne out of our experience in dealing with the subject. We feel happy that most of the suggestions given by us were accepted and made part of the recommendations of the Expert Group.

On 8th day of July, 2021, SEBI came up with a discussion paper inviting the comments of the public on the proposals to amend and merge SEBI (Share Based Employee Benefits) Regulations, 2014 and SEBI (Issue of Sweat Equity) Regulations, 2002 into a single regulation called SEBI (Share Based Employee Benefits and Sweat Equity) Regulations, 2021.

The changes in the two regulations and their merger into a single regulation were approved by SEBI in the Board Meeting held on 6th day of August, 2021. Thereafter, the SEBI (Share Based Employee Benefits and Sweat Equity) Regulations, 2021 have been notified and become effective on August 13, 2021.

With that, the Securities and Exchange Board of India (Share Based Employee Benefits) Regulations, 2014 and Securities and Exchange Board of India (Issue of Sweat Equity) Regulations, 2002 now stand repealed.

Key highlights of the changes under SEBI (Share Based Employee Benefits and Sweat Equity) Regulations, 2021

1. Definition of “Employee” [Regulation 2(1)(i)]

| As per the Erstwhile Regulations | As per the New Regulations |

Employee Means

but does not include—

| Employee, except in relation to issue of sweat equity shares, means —

but does not include—

|

| Rationale behind the Change | |

| |

2. Definition of “Grant Date” [Regulation 2(1)(q)]

| As per the Erstwhile Regulations | As per the New Regulations |

| Grant Date means the date on which the compensation committee approves the grant; | Grant Date means the date on which the compensation committee approves the grant. Explanation – For accounting purposes, the grant date will be determined in accordance with applicable accounting standards. |

| Rationale behind the Change | |

| Explanation has been inserted in the definition considering that the accounting standards also have a specific definition of the term “grant date” (whether or not benefits are granted in future) and this impacts the financial statements of the listed entity as well. | |

3. Implementation of the Scheme through Trust [Regulation 3(1)]

| As per the Erstwhile Regulations | As per the New Regulations |

| A company may implement schemes either directly or by setting up an irrevocable trust(s). Provided that if the scheme is to be implemented through a trust the same has to be decided upfront at the time of taking approval of the shareholders for setting up the schemes: | A company may implement a scheme(s) either directly or by setting up an irrevocable trust(s). Provided that if the scheme is to be implemented through a trust, the same has to be decided upfront at the time of taking approval of the shareholders for setting up the scheme(s). Provided further that if prevailing circumstances so warrant, the company may change the mode of implementation of the scheme subject to the condition that a fresh approval of the shareholders by a special resolution is obtained prior to implementing such a change and that such a change is not prejudicial to the interests of the employees. |

| Rationale behind the Change | |

| In the Erstwhile Regulations, the Companies were required to decide the route of the Scheme upfront at the time of obtaining the approval of the shareholders. Now with a view to provide flexibility to the Companies in switching the administration of a scheme under the SBEB Regulations from the trust route to the direct route and vice versa, if change in market conditions and other prevailing circumstances so warrant, the requisite insertions have been made under the new Regulations. | |

4. Compensation Committee [Regulation 5(2)]

| As per the Erstwhile Regulations | As per the New Regulations |

| The compensation committee shall be a committee of such members of the board of directors of the company as provided under section 178 of the Companies Act, 2013, as amended or modified from time to time. | The compensation committee shall be a committee of such members of the Board of Directors of the company as provided under regulation 19 of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, as amended from time to time: |

| Rationale behind the Change | |

Section 178 of the Companies Act, 2013 talks about the constitution of:

Therefore, in order to provide further clarification with regards to the Composition of Compensation Committee, it is now clarified in the new regulations that Compensation Committee shall be the Committee as provided under Regulation 19 of SEBI (LODR) Regulations, 2015. As per Regulation 19 of SEBI (LODR) Regulations, 2015, the Composition of Compensation Committee will be as follows: (a) the committee shall comprise of at least three directors; The Chairperson of the Nomination and Remuneration Committee shall be an Independent Director: Provided that the chairperson of the listed entity, whether executive or non-executive, may be appointed as a member of the Nomination and Remuneration Committee but shall not chair such Committee. | |

5. Appropriation of shares by the Trust [Regulation 3(12)]

| As per the Erstwhile Regulations | As per the New Regulations |

| The un-appropriated inventory of shares which are not backed by grants, acquired through secondary acquisition by the trust under Part A, Part B or Part C of Chapter III of these regulations, shall be appropriated within a reasonable period which shall not extend beyond the end of the subsequent financial year. | The unappropriated inventory of shares which are not backed by grants, acquired through secondary acquisition by the trust under Part A, Part B or Part C of Chapter III of these regulations, shall be appropriated within a reasonable period which shall not extend beyond the end of the subsequent financial year, or the second subsequent financial year subject to approval of the compensation committee/nomination and remuneration committee for such extension to the second subsequent financial year. |

| Rationale behind the Change | |

| In order to remove the difficulty being faced by certain stakeholders in relation to appropriation of shares acquired from secondary market in the ESOP Trust that are not backed by grants within a period of 1 year, the time period for the said appropriation has been extended by an additional period of 1 year. | |

6. Variation in the terms of the Scheme [Regulation 7]

| As per the Erstwhile Regulations | As per the New Regulations |

|

|

| Rationale behind the Change | |

| In order to provide more clarification with respect to the variation in the already approved scheme, the language of the stated regulation has been modified now to clarify that company shall be entitled to vary the terms of the schemes to meet any regulatory requirement without seeking shareholders’ approval by special resolution. | |

7. Adjustment in the limit of shareholding of Trust [Explanation to Regulation 3(11)]

| As per the Erstwhile Regulations | As per the New Regulations |

| Explanation 1: The above limits shall automatically include within their ambit the expanded capital of the company where such expansion has taken place on account of corporate action including issue of bonus shares, split or rights issue. | Explanation 1: The above limits shall automatically include within their ambit the expanded or reduced capital of the company where such expansion or reduction has taken place on account of corporate action(s) including issue of bonus shares, split, rights issue, buy-back or scheme of arrangement. |

| Rationale behind the Change | |

| In the Erstwhile Regulations, only the expansion of share capital was factored in the calculation of limits of shareholding of trusts under secondary acquisition. Now, under the new Regulations, the requisite changes have been made with a view to also factor the reduction of share capital in the calculation of limits of shareholding of trusts under the secondary acquisition. | |

8. Utilization of Fund/ Shares held by Trust in case of Winding Up of the Scheme [Regulation 8]

| As per the Erstwhile Regulations | As per the New Regulations |

| In case of winding up of the schemes being implemented by a company through trust, the excess monies or shares remaining with the trust after meeting all the obligations, if any, shall be utilised for repayment of loan or by way of distribution to employees as recommended by the compensation committee. | In case of winding up of the schemes being implemented by a company, the excess monies or shares remaining with the trust after meeting all the obligations, if any, shall be utilised for repayment of loan or by way of distribution to employees or subject to approval of the shareholders, be transferred to another scheme under these regulations, as recommended by the compensation committee. |

| Rationale behind the Change | |

| Earlier, the shares acquired by the Trust were necessarily required to be sold off at the time of winding up of the Scheme, Now, as per the New Regulations, in the event of winding up of the Scheme, the Trust can utilize the excess of shares available with it for the benefit of employees through a different scheme. | |

9. Applicability of Minimum Vesting Period in case of Death/ Permanent Incapacity [Regulation 9(4)]

| As per the Erstwhile Regulations | As per the New Regulations |

| In the event of death of the employee while in employment, all the options, SAR or any other benefit granted to him under a scheme till such date shall vest in the legal heirs or nominees of the deceased employee. | In the event of death of the employee while in employment, all the options, SAR or any other benefit granted under a scheme to him/her till his/her death shall vest, with effect from the date of his/her death, in the legal heirs or nominees of the deceased employee, as the case may be. |

| Rationale behind the Change | |

| To have a more lenient view in the special circumstances of death or permanent incapacity, and permit vesting immediately in such circumstances. | |

10. Vesting in case of superannuation/ layoff [Regulation 9(6)]

| As per the Erstwhile Regulations | As per the New Regulations |

| In the event of resignation or termination of the employee, all the options, SAR, or any other benefit which are granted and yet not vested as on that day shall expire: Provided that an employee shall, subject to the terms and conditions formulated by the compensation committee under the sub-regulation (3) of regulation 5, be entitled to retain all the vested options, SAR, or any other benefit covered by these regulations. | In the event of resignation or termination of an employee, all the options, SAR or any other benefit which are granted and yet not vested as on that day, shall expire: Provided that an employee shall, subject to the terms and conditions formulated by the compensation committee under sub-regulation (3) of regulation 5 of these regulations, be entitled to retain all the vested options, SAR or any other benefit covered by these regulations. Explanation—The cessation of employment due to retirement or superannuation shall not be covered by this sub-regulation, and such options, SAR or any other benefit granted to an employee would continue to vest in accordance with the respective vesting schedules even after retirement or superannuation in accordance with the company’s policies and the applicable law. |

| Rationale behind the Change | |

| In the Erstwhile Regulations, no specific treatment was prescribed with regards to the Cessation of employment of an Employee due to retirement or superannuation. Now as per the new Regulations, in the event of cessation of employment of an employee due to retirement or superannuation, the options, SAR or any other benefits granted to such employee will now continue to vest in accordance with their respective vesting schedules even after retirement or superannuation in accordance with company policies and applicable law. | |

11. Clarification on Cashless Exercise [Regulation 3(5), 3(15) and 9(2)]

| As per the Erstwhile Regulations | As per the New Regulations |

| Regulation 5(3): The compensation committee shall, inter alia, formulate the detailed terms and conditions of the schemes which shall include the provisions as specified by Board in this regard. SEBI Circular dated June 16, 2015 j. the procedure for cashless exercise of options / SARs. Regulation 3(15): The trust shall not become a mechanism for trading in shares and hence shall not sell the shares in secondary market except under the following circumstances: Regulation 9(2): No person other than the employee to whom the option, SAR or other benefit is granted shall be entitled to the benefit arising out of such option, SAR, benefit etc.: Provided that in case of ESOS or SAR, under cashless exercise, the company may itself fund or permit the empaneled stock brokers to fund the payment of exercise price which shall be adjusted against the sale proceeds of some or all the shares, subject to the provisions of the applicable law or regulations. | Regulation 5(3): The compensation committee shall, inter alia, formulate the detailed terms and conditions of the schemes which shall include the provisions as specified in Part B of Schedule – I of these regulations. Part B of Schedule – I Regulation 3(15): The trust shall not become a mechanism for trading in shares and hence shall not sell the shares in secondary market except under the following circumstances: (a) to enable the employee to fund the payment of the exercise price, the amount necessary to meet his/her tax obligations and other related expenses pursuant to exercise of options granted under the ESOS; Regulation 9(2): No person, other than the employee to whom the option, SAR or other benefit is granted, shall be entitled to the benefit arising out of such option, SAR or other benefit: Provided that in case of ESOS or SAR, subject to applicable laws, the company or the trustee may fund or permit the empanelled stock brokers to make suitable arrangements to fund the employee for payment of exercise price, the amount necessary to meet his/her tax obligations and other related expenses pursuant to exercise of options granted under the ESOS or SAR and such amount shall be adjusted against the sale proceeds of some or all the shares of such employee. |

| Rationale behind the Change | |

| Since the term and process of Cashless Exercise was not defined in the Erstwhile Regulations, now language has been modified with a view to clarify the mechanism of cashless exercise. Under the New Regulations, instead of using the term Cashless Exercise, the complete mechanism with respect to the same is now defined. Accordingly, the committee now can design the procedure of funding of exercise of Options, to enable the employee to fund the payment of exercise price and any other amount necessary to meet his tax obligations and other related expenses. Under the New Regulations, the word Cashless Exercise has been replaced to define the mechanism by which the company or the trustee may fund or permit the empaneled stock brokers to make suitable arrangements for the same. | |

12. Certificate from Auditor [Regulation 13]

| As per the Erstwhile Regulations | As per the New Regulations |

| In the case of every company that has passed a resolution for the schemes under these regulations, the board of directors shall at each annual general meeting place before the shareholders a certificate from the auditor of the company that the scheme(s) has been implemented in accordance with these regulations and in accordance with the resolution of the company in the general meeting. | In the case of every company which has passed a resolution for the scheme(s) under these regulations, the Board of Directors shall at each annual general meeting place before the shareholders a certificate from the secretarial auditors of the company that the scheme(s) has been implemented in accordance with these regulations and in accordance with the resolution of the company in the general meeting. |

| Rationale behind the Change | |

| In the Erstwhile Regulation, there was no clarity with regards to whether such certificate should be provided by the statutory auditor, internal auditor or secretarial auditor. Now, under the new Regulations, the term Auditor is replaced with the Secretarial Auditor as the Secretarial Auditor is more conversant with these laws compared to other categories of persons, and it is the secretarial auditor that is required under Regulation 24A of the LODR Regulations, to furnish a secretarial audit report on an annual basis. | |

13. Buyback of Stock Options [Schedule 1 (Part-B]

| As per the Erstwhile Regulations | As per the New Regulations |

| The Compensation Committee is required to formulate the detailed terms and conditions of the schemes which shall, inter alia, include the following provisions: k. the procedure for buy-back of specified securities issued under these regulations, if to be undertaken at any time by the company, and the applicable terms and conditions, including: (i) permissible sources of financing for buy-back; | |

| Rationale behind the Change | |

| Since stock options may be settled without being exercised by various means, including by way of cash disbursements in lieu of exercise, or settled by way of processes similar to cashless exercise, it would be more meaningful for the procedures and terms and conditions applicable to any buy-back of stock options to be included in the scheme itself, and approved by the compensation committee and the shareholders of the listed company | |

14. Maximum value of shares in case of GEBS [Regulation 26(2)]

| As per the Erstwhile Regulations | As per the New Regulations |

| At no point in time, the shares of the company or shares of its listed holding company shall exceed ten per cent of the book value or market value or fair value of the total assets of the scheme, whichever is lower, as appearing in its latest balance sheet for the purposes of GEBS. | The shares of the company or shares of its listed holding company shall not exceed ten per cent of the book value or market value or fair value of the total assets of the scheme, whichever is lower, as appearing in its latest balance sheet (whether audited or limited reviewed) for the purposes of GEBS. |

| Rationale behind the Change | |

| The term “at no point of time” has been deleted under the new regulations due to fluctuation in the share prices, as under the Erstwhile Regulations, it was difficult to measure the stated metrics every time. Now, as per the new Regulations, it is clear that the stated metrics are required to be measured as on the date of the balance sheet. | |

15. In-principle approval from the Stock Exchange [Regulation 12(3)]

| As per the Erstwhile Regulations | As per the New Regulations |

| For listing of shares issued pursuant to ESOS, ESPS or SAR, the company shall obtain the in-principle approval of the stock exchanges where it proposes to list the said shares. | For listing of shares issued pursuant to ESOS, ESPS or SAR, the company shall obtain the in-principle approval of the recognized stock exchanges where it proposes to list the said shares prior to the grant of options or SARs. |

| Rationale behind the Change | |

| As per the Erstwhile Regulations, there was no clarity with regards to the stage at which the application for seeking the in-principle approval from the stock exchange shall be made. Now, as per the new Regulations, it is clarified that the application for seeking the in-principle approval from the stock exchange shall be made prior to the grant of options. | |

16. Objective/ Purpose for the Issue of Sweat Equity Shares [Regulation 30]

| As per the Erstwhile Regulations | As per the New Regulations |

| A company whose equity shares are listed on a recognized stock exchange may issue sweat equity shares in accordance with Section 79A of Companies Act, 1956 and these Regulations to its– (a)Employees (b)Directors | A company whose equity shares are listed on a recognised stock exchange may issue sweat equity shares in accordance with section 54 of the Companies Act, 2013 and these regulations to its employees for their providing know-how or making available rights in the nature of intellectual property rights or value additions, by whatever name called. |

| Rationale behind the Change | |

| As the Erstwhile Sweat Equity Regulations did not specify permissible purpose/objective for issuance of sweat equity shares, as are provided under the Companies (Share Capital and Debentures) Rules, 2014 (applicable only to unlisted companies). Since the purpose of issuance was not provided, the listed companies were not clear as to whether issuance of sweat equity shares was entirely discretionary or permitted only for certain purposes/objectives. Now, in order to streamline the same, the Objective/ purpose for the issue of sweat equity shares has been specified under the new Regulations. | |

17. Maximum quantum of Sweat Equity Shares [Regulation 31]

| As per the Erstwhile Regulations | As per the New Regulations |

| A company shall not issue sweat equity shares for more than fifteen percent of the existing paid-up equity share capital in a year: Provided that the issuance of sweat equity shares in the company shall not exceed twenty five percent of the paid-up equity share capital of the company at any time: Provided further that a company listed on Innovators Growth Platform shall be permitted to issue not more than fifteen percent of the paid-up equity share capital in a financial year subject to overall limit not exceeding fifty percent of the paid-up equity share capital of the company, up to ten years from the date of its incorporation or registration. | |

| Rationale behind the Change | |

| As there was no limit provided in the Erstwhile Regulations with regards to the maximum quantum of sweat equity shares, the Listed Companies were allowed to issue sweat equity shares to any extent. In a view of the same, SEBI has specified a quantum which has to be followed by listed Companies issuing Sweat Equity Shares. | |

18. Lock In Period for Sweat Equity Shares [Regulation 38]

As per the Erstwhile Regulations | As per the New Regulations |

| (1) The Sweat Equity shares shall be locked in for a period of three years from the date of allotment. (2) The Securities and Exchange Board of India (Disclosures and Investor Protection) Guidelines, 2000 on public issue in terms of lock-in and computation of promoters’ contribution shall apply if a company makes a public issue after it has issued after it has issued sweat equity | (1) The sweat equity shares shall be locked in for such period of time as specified in relation to a preferential issue under the Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2018, as amended from time to time. (2) The provisions of the Securities and Exchange Board of India (Issue of Capital and Disclosures Requirements) Regulations, 2018 in respect of public issue in terms of lock-in and computation of promoters ‘contribution shall apply if a company makes a public issue after it has issued sweat equity shares. |

| Rationale behind the Change | |

| It was considered that the lock-in period of 3 (three) years provided under the Erstwhile Regulations which was having an adverse impact on the attractiveness of sweat equity shares. Therefore, the suitable changes with regards to the lock-in period have been made with a view that the lock-in period should be consistent with the lock-in period prescribed in relation to preferential issue under the ICDR Regulations. Therefore, the Lock-in period for the Sweat Equity shares shall be 3 years from the date of allotment of shares in case such shares are allotted to Promoters/ Promoter Groups. However, in case where the shares are issued to any person other than Promoter/ Promoter Group, the shares shall be locked in for a period of 1 year. | |

19. Pricing Requirements for Sweat Equity Shares [Regulation 33]

As per the Erstwhile Regulations | As per the New Regulations | ||||||

| (1) The price of sweat equity shares shall not be less than the higher of the following:(a) the average of the weekly high and low of the closing prices of the related equity shares during last six months preceding the relevant date; or (b) the average of the weekly high and low of the closing prices of the related equity shares during the two weeks preceding the relevant date. | The price of sweat equity shares shall be determined in accordance with the pricing requirements stipulated for a preferential issue to a person other than a qualified institutional buyer under the Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2018. | ||||||

| Rationale behind the Change | |||||||

| As per the new Regulations, the Pricing of the Sweat Equity Shares will be at par with the pricing requirement stated under ICDR Regulations with regards to Preferential issue. Therefore, as per the new Regulations, the Pricing of the Sweat Equity Shares will be done in a given below manner:

| |||||||

To make the Erstwhile Regulations more robust, syncing the same with best global practices and ease of doing business, these newly promulgated regulations are a welcome change to the Industry.

Corporate Professionals is the destination for all your ESOP related needs, be it Advisory, Preparation or Implementation. We under our umbrella “ESOP online” aim to build long term incentive plans that are customized to a particular organization and its employees. Competencies of our Professionals comprising Company Secretaries, Chartered Accountants and Lawyers with their expert knowledge on the subject would help you right from the Advisory and Preparation till the Implementation of an ESOP plan and thereby enhancing the overall productivity of the organization.

Through our strong foundations and robust growth, we have emerged as a leading corporate advisor attaining an edge in providing services at internationally competitive standards, utterly justifying our brand Corporate Professionals.

We offer 360-degree package services under ESOPs as well as independent services.