In India’s fast-growing startup and corporate ecosystem, attracting and retaining the right talent is not just an important- it’s a survival strategy. Employee Stock Option Plans (ESOPs) have been emerged as one of the most powerful and strongest tools companies in India now rely on.

But simply offering ESOPs is not enough. What really matters is how well they are designed, especially the vesting structure. The vesting time (duration), vesting percentage (% of options that vest), and vesting conditions (time, performance- of employee or of the Company, or milestones) are not just compliance requirements — these are the strategic levers that determine whether ESOPs will truly motivate and reward employees.

Why ESOP Vesting Design Matters for Indian Companies

There’s no one-size-fits-all ESOP. A “copy-paste” ESOP Scheme rarely works — especially for CXOs, senior managers, and key employees who drive business outcomes.

For Indian companies, a well-thought-out ESOP should:

- Encourage long-term retention with a clear and motivating vesting time

- Link wealth creation to company-wide performance (not just tenure).

- Reward major business milestones such as funding rounds, IPO, or profitability

- Create a sense of ownership, aligning employee’s growth with company’s growth.

When done right, a well-designed ESOPs keep top talent motivated and loyal, even during tough times like funding crunches, market slowdowns, or when competitors try to poach them.

Popular ESOP Vesting Structures in India

Companies usually use a mix of time-based vesting (to retain talent) and performance-based vesting (to push growth) in the following manner:-

- Time-Based Vesting (Retention-Focused)

This is the most common and straightforward approach, where a specific % of ESOPs vest over a fixed period of time.

Example: Cliff Vesting after 4 years – No vesting in initial years, then 100% vests on the completion of specified period (4 years). Alternatively, vesting can be structured to start lower in the first and second years and gradually increase in the later years.

Goal: Builds loyalty and reduces early attrition/exits.

- Company Performance-Based Vesting (Growth-Linked)

Here, vesting is tied to company’s -wide performance metrics, not individual KPIs, such as:

- Hitting Revenue milestones (e.g., ₹50 Cr annual revenue)

- Achieving Year-on-year growth % (e.g., ≥15% YoY)

- Reaching Profitability targets (EBITDA breakeven or positive margin)

- Strategic goals (IPO, fundraise, market entry)

Goal: Ensures employees benefit only when the company creates value.

- Hybrid Vesting (Retention + Company Growth)

This is the sweet spot and t effective approach combining time-based vesting with performance triggers, ensuring that employees stay engaged over the long term and focus on results.

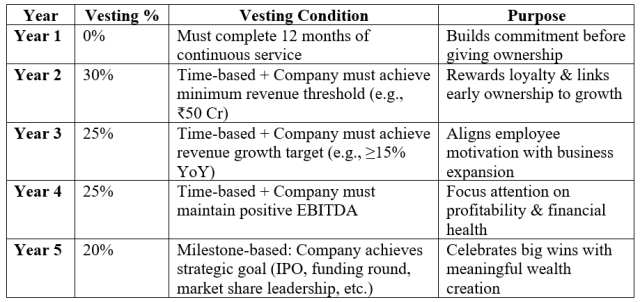

Here is a sample of Hybrid Vesting Schedule for ESOPs:-

Why This Structure Works for Indian Companies

- Simple and Clear: Employees work towards the same company-wide goals, without complicated individual targets.

- Retention-Focused: Vesting over time keeps employees engaged through critical growth stages.

- Value-Linked: ESOPs create real value only when the business succeeds, tying rewards to company performance.

A well-designed ESOP is more than a reward — it is a strategic growth driver for Indian businesses. By carefully structuring vesting time, vesting %, and company performance conditions.

Conclusion

ESOPs in India have moved beyond being just a “startup perk” — they are a wealth creation and culture-building strategy. Employees who see their personal success tied to the company’s growth stay more invested, work harder, and push innovation forward. If designed well, they help employees build real wealth, driving innovation, profitability, and long-term value creation.

That’s how ESOPs turn into a powerful growth engine, when employees succeed alongside the company, it creates a positive cycle that drives long-term growth.